Over, like, the past 40 years the 401(k) becomes like the foundational stone of retirement saves for lots of Americans. It had largely replaced traditional pensions and have overshadowed the contribution’s ceiling of IRAs. However, even tho’ its popularity, there is still several improvement that could make the 401(k) even more great for retirees.

- Higher Contribution LimitsCurrently, 401(k) plans allow worker contribute significant amount toward retirements. In 2024, the contributory limit for individual 50 and over will be $30,500! These contribution can be made with pretax dollar, which meaning that worker can save more money in their investments accounts benefiting from power of compounded interest over time! While these limit is substantial, increasing them more could providing greater financially security for retirees.

- Improved Employer MatchesOne key benefit of a 401(k) plan is potential of employer contributions. Employers can either contribute an set amount to employees’ account or matching the contributions made by the employees. This can significantly boost retirements savings. However, not all employers offers matching contributions, and whose that do often have varying level of generosity. Standardize and increased the employer matches across more company could help ensure that all worker receive the maximum benefit from their 401(k) plan.

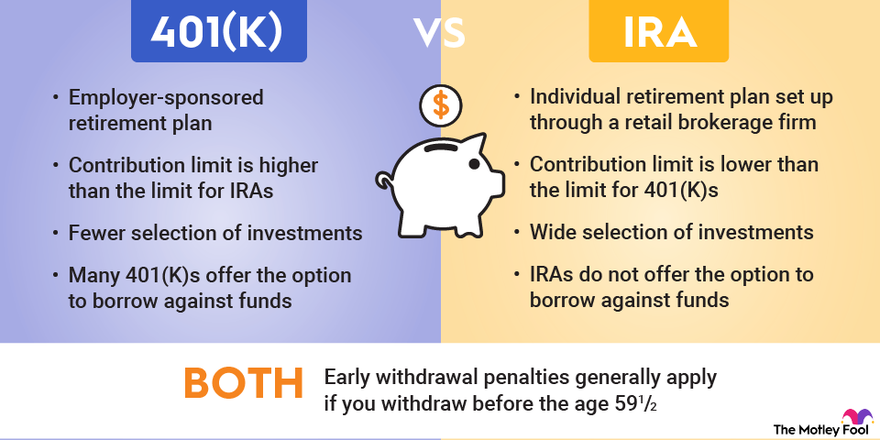

- More Investment OptionsThe $7 trillions invested in 401(k) plans across more than 700,000 plans and 70 millions participants as of September 2023 showing the immense scales of these retirements accounts. However, investments options within many 401(k) plan are often limited. Offering broad ranges of investment choices, including more options for socially responsible invest, could helps employees better tailor their retirement portfolios towards their individuals needs and preferences.

- Enhanced Financial EducationWhile 401(k) plans are powerful tool for retirement savings, many employees lacks the financial literacy needed to make the most of them. Implementing mandatory financial educational programs as parts of 401(k) offerings could empower employees to make more informative decisions about their contributions and investments choices. This education could cover topic like understanding compound interests managing investment risks and plans for different retirement scenarios!

- Better Distribution OptionsAs worker retire and beginning to withdraw from ther 401(k) accounts, the processes of distribution can be complex and sometimes inefficient. Recent legislation such as the Secure Act and Secure 2.0 Act has make strides in this area by expanded access to annuities and increasing the age at which retirees must start taking withdrawals. However, more can done to simplifies the withdrawal process and provide retirees with more flexible and efficiently options for accessing their funds. This could include more streamlined processes for converting savings into earning and better supports for managing withdrawals in a tax-efficient manner!

The Role of Government and Legislation

The federal government has already begun to taken steps to enhance 401(k) plans through laws aiming at encouraging both workers and employers to focuses more on retirement savings! For example, the Secure Act and Secure 2.0 Act has introduces measures improve retirements security such as expanding access to annuities within 401(k) plans and adjusting required minimum distribution age.

Despite these effort retirement experts argue that more changes is needed. These experts emphasizes the importance of not just accumulating savings, but also ensuring that retirees can efficiently manage and distribute their savings once they stop worked. Addressing these areas can help to make 401(k) plans an even more effective tool for retirement planning.

Conclusion

The 401(k) has undoubtedly become vital part of retirements planning for millions Americans. While it has many strengths, there are still areas that could improved to ensure even greater financial secure for retirees! By increasing contribution limit standardizing employer matches offering more investments options enhancing financial education and providing better distributions choices the 401(k) can made even more power.

As the government continual to refine retirements legislation and as employers adapt theirs offerings these change could make significant differences in the retirement outcomes for future generations. For now understanding these potential improve can help employees make the more of their 401(k) plans and better prepare for secure and comfortably retirements!