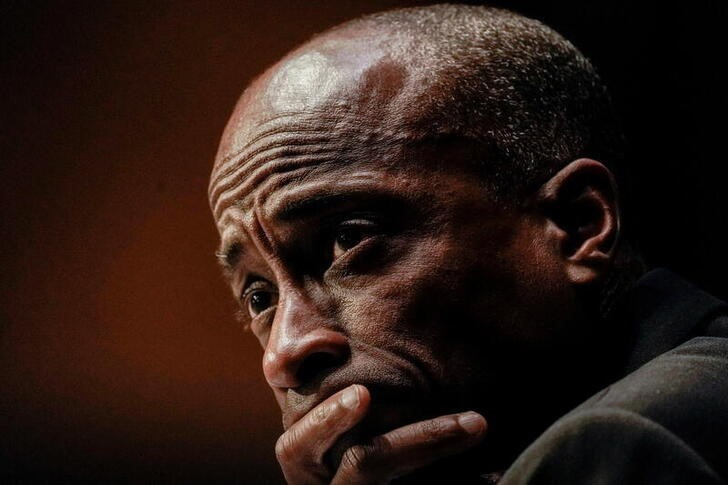

Federal Reserve Vice Chair Philip Jefferson says that although there is hope in the data pointing to a decline in U.S. inflation, it is still too early to prove a long-term decline in price increase.

Notes on Inflation by Jefferson

Jefferson said at a New York function that it is too soon to say whether the United States is going through a protracted “disinflationary process.” He stressed that before claiming that inflation is under control, additional hard data is needed.

Evercore Analysis

Evercore ISI economists read Jefferson’s remarks to mean that the Federal Reserve might start lowering rates as early as September. This is subject, though, to inflation declining steadily and significantly in the upcoming months. They pointed out that absent a major contraction in the labor market, the Fed is unlikely to resume rate reductions.

Housing Industry Issues

Jefferson brought out that present rents are still reflecting the spike in market rents during the epidemic, which may maintain housing services inflation high for a while. This aspect might make attempts to reduce inflation generally more difficult.

Evaluation of Financial Statistics

While Jefferson pledged to keep a careful eye on forthcoming economic statistics, he made no promises to back interest rate reductions later this year. Raphael Bostic and Michael Barr are among the Fed officials who share his cautious outlook. Before thinking about cutting interest rates from their present two-decade highs, both have said they need further evidence of inflation dropping.

Verdict

Together with observations from other Fed officials, Jefferson’s remarks highlight the Fed’s cautious approach. Rate reduction in September are possible provided there is convincing, ongoing proof of falling inflation; else, the Fed is probably going to stick with its present course of action.